25.90% p.a. compounded if the payment of the closing balance in your statement is not made in full; or 29.99% p.a. in the event that your Account has three or more defaults and/or one default which remains unpaid for two or more consecutive months in the last 12 months.

Annual Fee

S$171.20 (inclusive of GST) waived for the first year.

Annual Supplementary Card Fee

First 2 Supplementary Cards fee permanently waived. S$85.60 (inclusive of GST) for each subsequent Supplementary Card.

Minimum monthly payment

3% or S$50, whichever is higher.

Cash advance fee

Handling fee of 5% of your withdrawal amount will apply for each withdrawal amount.

Fees for foreign currency transactions

2.5%

American Express International, Inc.

Crawford Post Office

P.O. Box 852

Singapore 911912

1800 299 1997 (for local use only)

Benefits & Features

Minimum annual income

APR

Annual fee

Minimum age

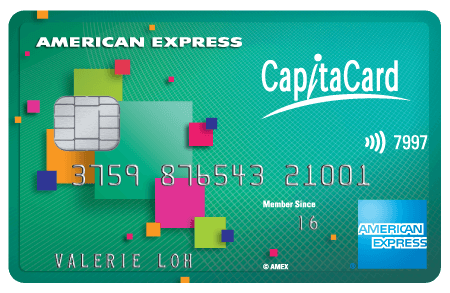

Unlimited Cashback Credit Card

Benefits: 1.5% cashback on all spend, All-in-one card, S$100 cashback or S$150 in Prime Now Credits, Up to 50% off a la carte dining, Fund transfers, EasyPay.

Benefits & Features

Minimum annual income

APR

Annual fee

Minimum age

Spree Credit Card

Benefits: 3% cashback on all online spend in foreign currency, 2% cashback on all online spend in local currency, Online Shopping Protection, Fund transfers, EasyPay.

Benefits & Features

Minimum annual income

APR

Annual fee

Minimum age

American Express Platinum Credit Card

Benefits: Up to 50% off food bill at hotels, Vouchers from spas, Membership Rewards points, Frequent Flyer Miles, 90-days return guarantee and purchase protection.

MoneyGuru SIA, Address: Rīga, Latvia, Kārļa Ulmaņa gatve 2, LV-1004

Registration number: 41503072001 Bank: Swedbank AS, E-mail: partner@moneyguru24.com

Copyright © MoneyGuru 2012-2024. All rights reserved.